NatWest Rooster Money

Card for ages 6-17. Parent/guardian must be 18+ and UK resident. Card designs subject to availability. Subscription fees apply via auto renewal after first month’s trial has ended. Usually £1.99 a month or £19.99 a year. Other fees may apply. T&Cs apply.

A Head Start with Money

We started Rooster Money because we believe that through an early and hands-on introduction to the world of finance, kids get confident with money. And this prepares them for a brighter future.

For some of us, the need to get to grips with money only really hits us when we start living with someone else, or when we have responsibilities such as bills to pay. It seems pretty crazy that so many of us muddled our way through learning about personal finance, given its importance in our everyday lives.

Our app will guide you through introducing kids to the fundamentals of the world of money: how to spend, save, earn and give. Ultimately, preparing kids to confidently take the reins of their own finances.

Card for ages 6-17. £1.99/mo or £19.99/yr. Criteria and T&Cs apply. Other fees may apply.

Pocket Money Matters

Like learning a language, it’s much easier to develop positive habits around money when you’re young. Research shows that we’ve formed many of our basic money habits by the age of 7 (Money Advice Service). Pocket Money offers us practical ways to introduce kids to some of those fundamental concepts that we will use for the rest of our lives. Enabling real experiences with, and regular conversations about, money.

Like everything else on the list of parent ‘to-dos’, remembering who gets what and when with pocket money can get confusing. And as the world becomes increasingly cashless, it’s harder to make money tangible for our kids. So what do we do?

Rooster Money Could Make It Easier

Built for busy family life, our app introduces financial principles we were brought up with (or wish we were raised with!) and could make managing pocket money relevant and simple.

Rooster Money starts children on their journey to financial independence; through features such as our Star Chart, to a Virtual Pocket Money Tracker, then ultimately to their own Rooster Card. We give kids the independence they want and parents the reassurance they need. The app has a bunch of flexible and helpful features that make managing pocket money straightforward, with both parent and child logins.

Star Chart ages 3+. Virtual Tracker ages 5+. Card for ages 6-17. Parent/Guardian must be 18+ and a UK resident. £19.99/yr or £1.99/mo. Other fees may apply. T&Cs apply.

We also know what we are talking about. We’ve featured in The Times, Telegraph and Guardian, as well as the Wall Street Journal and Which? to name a few. Our Pocket Money Index also shares the latest insights about pocket money, straight from our user data.

Becoming NatWest Rooster Money

In October 2021, we joined NatWest Group. May 2022 saw us officially become NatWest Rooster Money: combining the decades of NatWest banking experience, with the fintech expertise of Rooster Money. Wrapped up in a fresh new look, we’re now ready and excited to make an even bigger impact.

As seen in

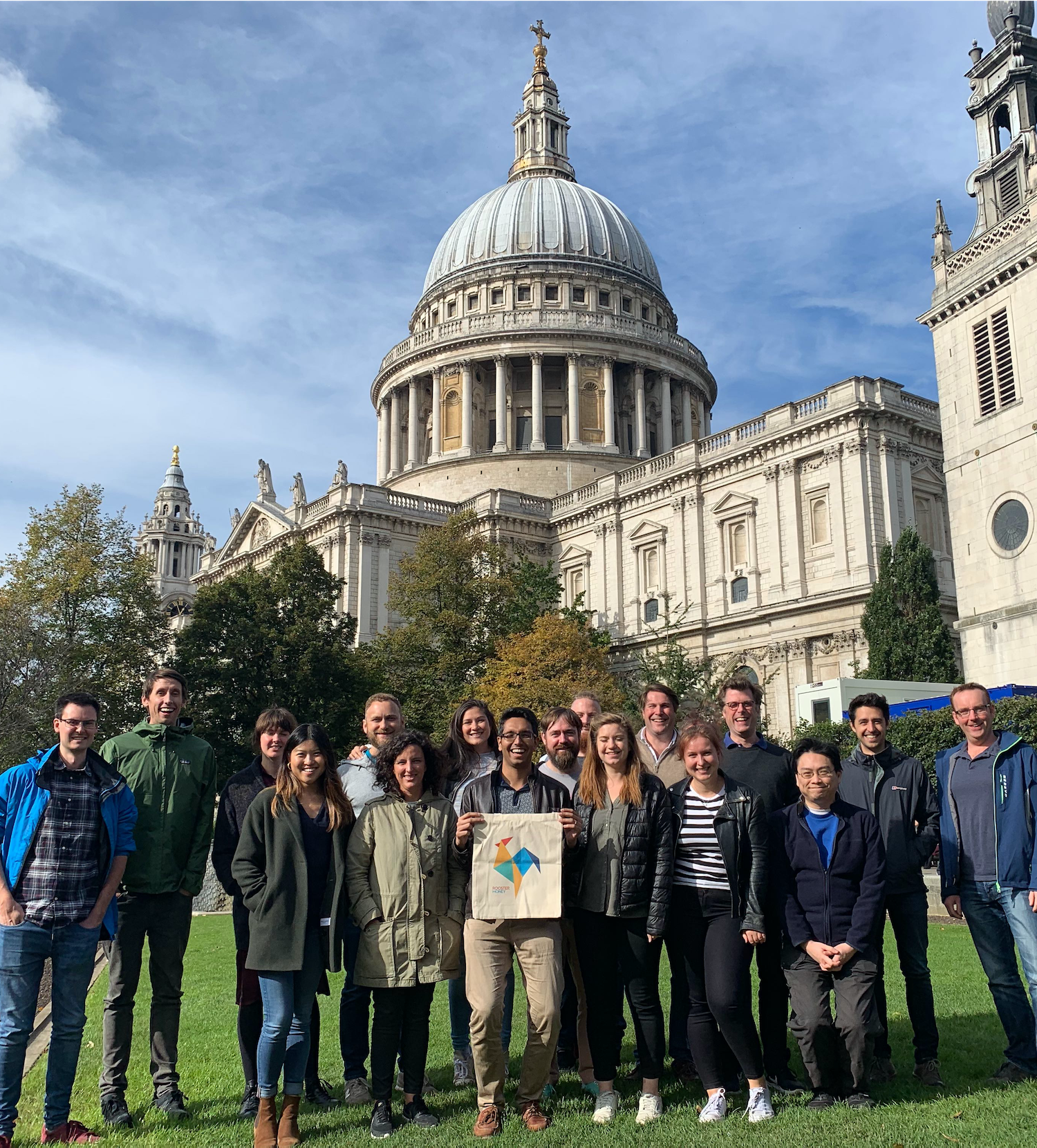

The Team

We’re developers, makers, product people, designers, customer ops champions, finance experts, data whizzes and marketeers who believe you can have a positive impact on the world whilst building a brilliant business. Some of us are parents, some aren’t. Some have worked in some really big global businesses, for some it’s their first job. Everyone is really good at what they do and believe in what we’re doing!

Working remotely makes the school run easier, but we make sure we get together regularly and have (a lot of) fun doing it too. If you’re interested in joining the Rooster Money team, head to Workable for our latest roles.

World Learning Limited, Registered in England and Wales No.06830114. Registered Office: 64 New Cavendish Street W1G 8TB.

Bristol

Disco dancing team building

London

Catching up with the team over All Hands

London

Team photo on a sunny London day