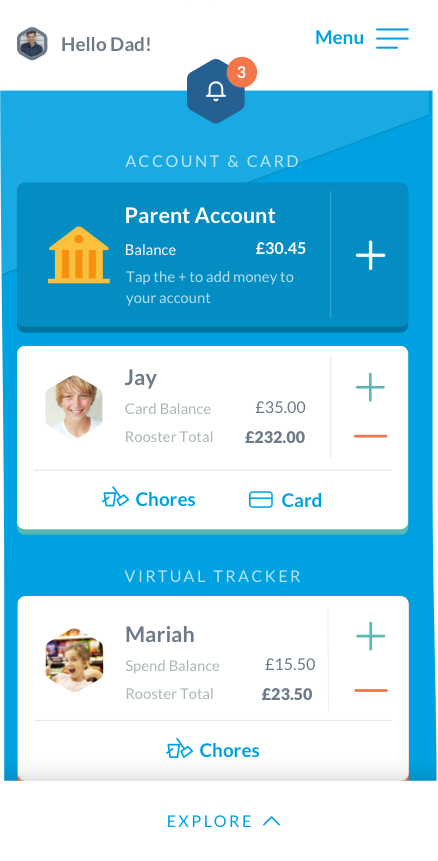

Add your kids

Rooster Money supports kids of all ages on their journey to financial independence. When you first add your children, they are all set up with the Virtual Money Tracker. However, this virtual money is converted to real money when you order the Rooster Card – for kids ready to have for their first prepaid debit card (must be aged 6-17).

Set your family’s routine

Weekly, fortnightly or monthly? Choose what pocket money you’d like to give and how often. This gets automatically delivered to your child’s Spend pot on allowance day. Want them to earn as they go? You can Boost them money as and when instead or set them extra earner chores with the Rooster Card. Limits apply.

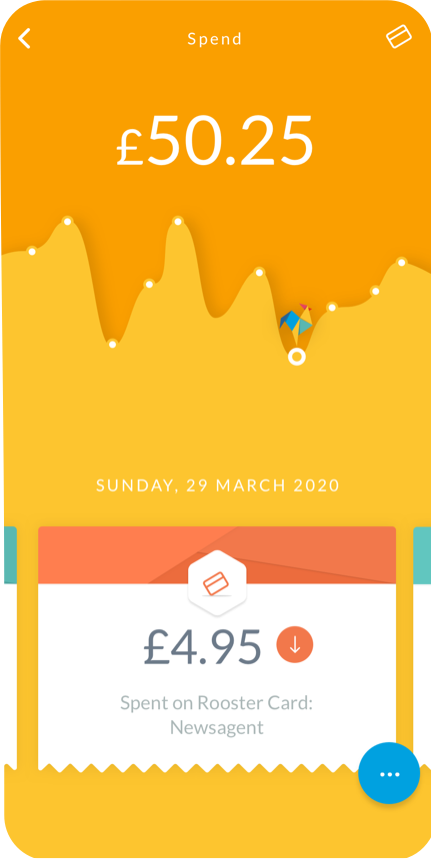

Track their earning and spending

If your child has a piggy bank with savings already, you can ‘Boost’ this amount to your child’s Spend pot so they can start saving! Boosts can be used to add money or rewards and you can use ‘Remove’ to deduct funds – like when you spend on their behalf. This can be quickly done from the parent dashboard by tapping the + and – symbols. You can add reasons too so you know what it’s related to!

If your child is using the Rooster Card, any spending gets deducted from their Spend pot. You can easily see what money is coming in and out of your child’s account by viewing their pot transactions or history.

Elevate their savings with personalised Pots

You and your child can customise their dashboard by adding new Pots that better reflect what they want to put their allowance towards. Just tap the add button on your child’s dashboard to add personalised Pots. They can then easily see what they’re saving for!

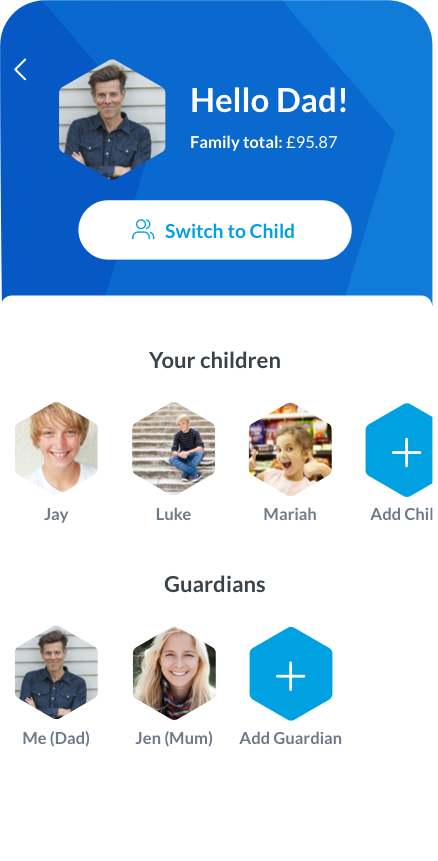

Get the whole family involved

Add a secondary parent or guardian to help manage your Rooster Money account. This means both mum and dad can keep track of earning and spending, alongside chores completed – which is included with the Rooster Card.

Kids can login with their own devices to manage their savings and goals. You can set up their details from ‘Manage Account’.

The best way to learn is by doing. Get your kids managing their own account, so they can start making decisions on what to allocate where. With your guidance, you can create space to talk about money, like the difference between a need and want, and the value of saving for a rainy day!

Start your kids on their saving journey!

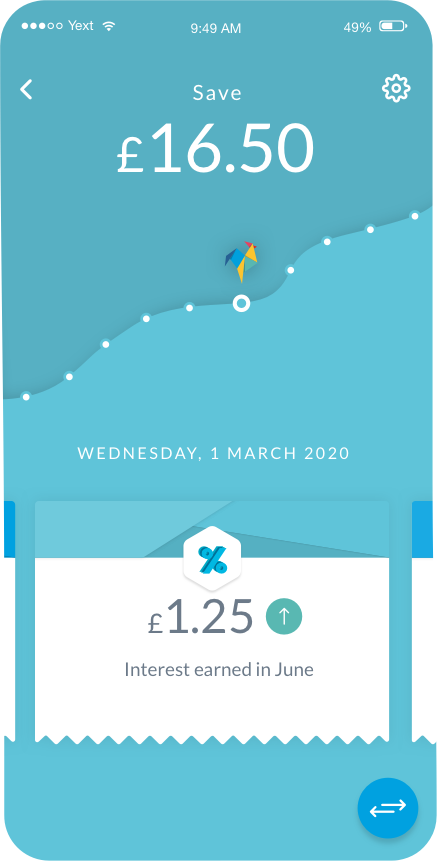

Now that you’re all set up, your children can start saving towards goals and allocate their pocket money towards them. They can also stash away money in ‘Save’, to learn the value of long term saving for a rainy day!

To help encourage saving, you can set a Split Allowance on the Spend, Save and Give pots to send a % of their money to each pot on pocket money delivery day! With the Rooster Card you can even set a parent-paid interest rate on savings to sweeten the deal.

How to get the Rooster Card?

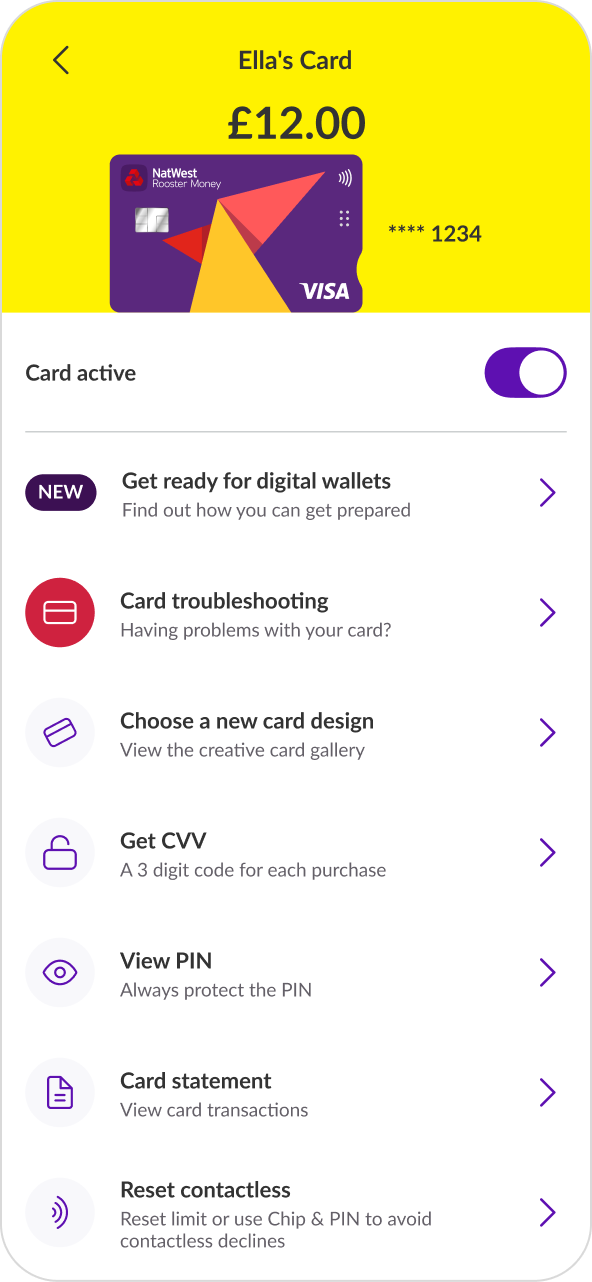

You can subscribe to the Rooster Card in the app by tapping on ‘Account & Card’ in the menu. From there you can take out a subscription for the number of cards you’d like to set up for your children. The first month is free for your family to try out. Subscription fees apply via auto renewal after first month’s trial has ended. Usually £1.99 a month or £19.99 a year.

The Rooster Card includes:

- Prepaid debit card for your child

- Sort code and account number so family & friends can contribute to your child’s account

- Flexible spending controls and limits for peace of mind

- Real-time spending notifications

- One off CVV codes generated in the app

- Card management in app including the option to view the PIN or freeze the card

Pick their favourite

Making choices is a big part of growing up, and money.

When you order their Rooster Card, kids can pick from our trio of free designs. Or you could go for something a bit special – like these ones.

Find them all in your app.

Designs shown are £4.99. Card designs are subject to availability.