Kids’ overall income, which includes payments for doing extra chores as well as one-off rewards and treats, follows a similar curve, rising steadily as they get older. Six-year-olds are earning £4.99 a week, while 17-year-olds are earning £23.97.

The Pocket Money Index 2025

Take a look at data from over 350,000 kids’ spending, saving and earning habits in our annual Pocket Money Index. Read on to have all your questions answered on pocket money for kids, their weekly allowance, and how today’s youngsters are already building their money confidence.

Data gathered from Rooster Card families from 1st March 2024 - 28th February 2025

Pocket money essentials: a quick guide for parents

Saturday is still the most popular pocket money payday, favoured by 45% of families. However, we also found that families are often topping up kids’ accounts here and there, through payments for extra chores, one-off rewards for things like hard work in school or preparing for exams, and treats for special occasions such as birthdays.

If you’re looking for some inspiration for help around the house, check out our handy pocket money chores list for more ideas to help your kids earn some extra cash.

Taking solely regular pocket money into account, kids received an average £3.85 each week – though as you’d expect, the amount being given to those from primary school age through to older teens really varies, with 17-year-olds receiving the highest weekly allowance. Over the year, kids received on average £474.76. Bear in mind that this sums up regular pocket money and any extra top-ups and earners, like side hustles and chores.

If you’re looking for answers on how much pocket money to give your kids, check out our ‘how much pocket money to give?’ article which breaks down weekly allowance by age.

Over a quarter (27.4%) of families have a regular pocket money allowance set up. And of these families with a fixed routine, over a third (34.8%) make pocket money payment compulsory for getting chores done – that’s one way of motivating them to keep their room tidy!

With all that pocket money, it can be tough for kids to decide what to do with it all. Read our article on helping your kids to save money to make sure they’re building good money habits with all the pocket money they’ve received.

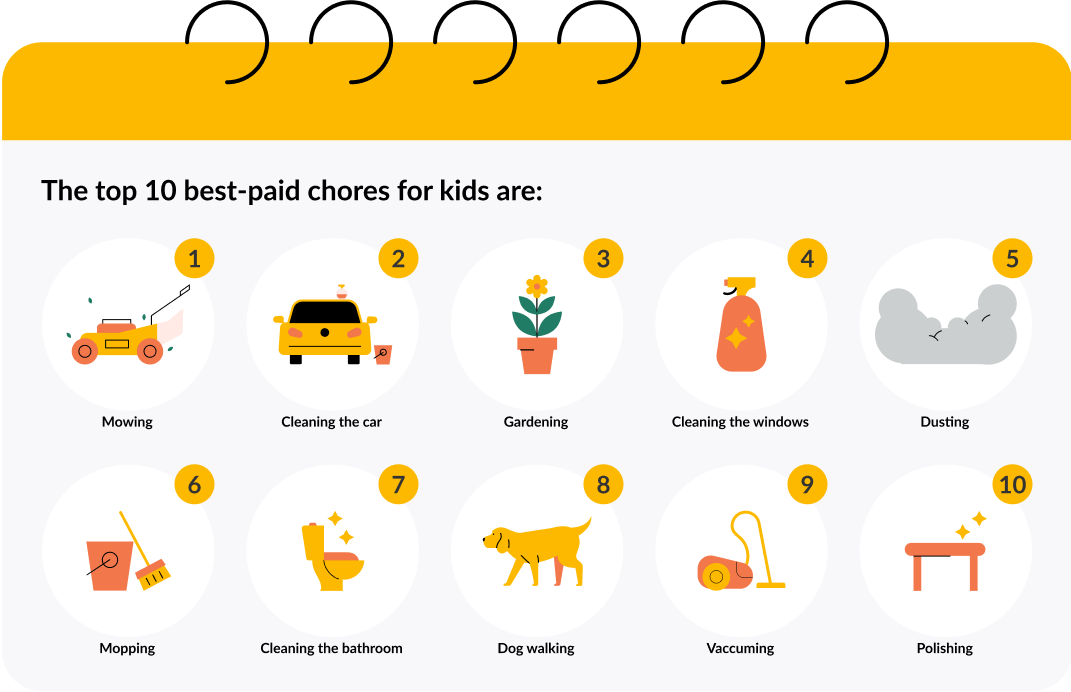

It pays for kids to be handy outdoors as mowing the grass (£3.68), cleaning the car (£3.33), and gardening (£1.66) ranked as the top three best paid chores this year.

Outside of the best paid chores, the most popular chores for kids to complete were making the bed (the most popular for the third year running), washing the dishes and cleaning their bedroom.

Make sure to check out our ‘summer chore ideas for kids‘ article where we break down the going rate for other popular chores.

We’re here to help with all things pocket money

The Rooster Card can help your kids get to grips with money through their very own card. With alerts and controls for your peace of mind, pots to help them start saving and budgeting, and advanced chore tracking features, you can help your kids take the next steps towards confident money management.

Card for ages 6-17. Parent/guardian must be 18+ and UK resident. Card designs subject to availability. £19.99/yr or £1.99/mo. Other fees may apply. T&Cs apply.

Find out moreIncome

Once again, pocket money trends reveal that age is more than just a number, as regular pocket money allowance for kids increases according to age range. 17-year-olds enjoy the highest weekly pay out at an average £8.31 a week – though this has decreased slightly, at 11p less than last year. Meanwhile, six-year-olds’ average pocket money comes in at £2.81 a week – a 6p improvement on last year.

Weekly regular pocket money by age

(excluding boosts and jobs)

Weekly overall income by age

The chore cheatsheet

Determined kids are working harder than ever to top-up their income by taking on extra chores and responsibilities – with parents stepping up too, by increasing the value of chores. For kids hoping to maximise their earning potential, mowing the lawn remains the best paid chore for the second year running, coming in at an average of £3.68 per job – that’s an increase of 21p (6.1%) on last year’s rate.

With generous parents rewarding their kids more for some key chores, it’s clear that kids aren’t afraid to roll up their sleeves and get their hands dirty when it comes to learning the value of money and hard work.

The best paid chores

Extra earners

Outside of chores, kids tend to receive top-ups (that we call ‘boosts’) throughout the year. Birthday money (£45.44) remains at the top of the list, as well as occasional treats from generous family members. Kids are also being rewarded for their achievements at school, especially around homework and reading.

Last but not least a visit from the Tooth Fairy is providing a whopping £4.21 boost on average – with kids averaging 20 milk teeth they’d get roughly £84.20 over the years!

Saving

Kids managed to retain £30.38 over the year (or 6.4% of the year’s income) which shows savings have fallen by 33% since last year. Age plays a big factor here as the data shows that older kids tend to spend more of their income whereas younger kids prefer to save – with six-year-olds still having on average 31.4% of their income stashed away at the end of the year.

Although older kids are saving less than their younger counterparts, they’re continuing to demonstrate great money skills by setting goals and completing chores to work towards their wants and needs. Practicing these healthy money habits regularly all helps towards building their money confidence and gaining that extra independence.

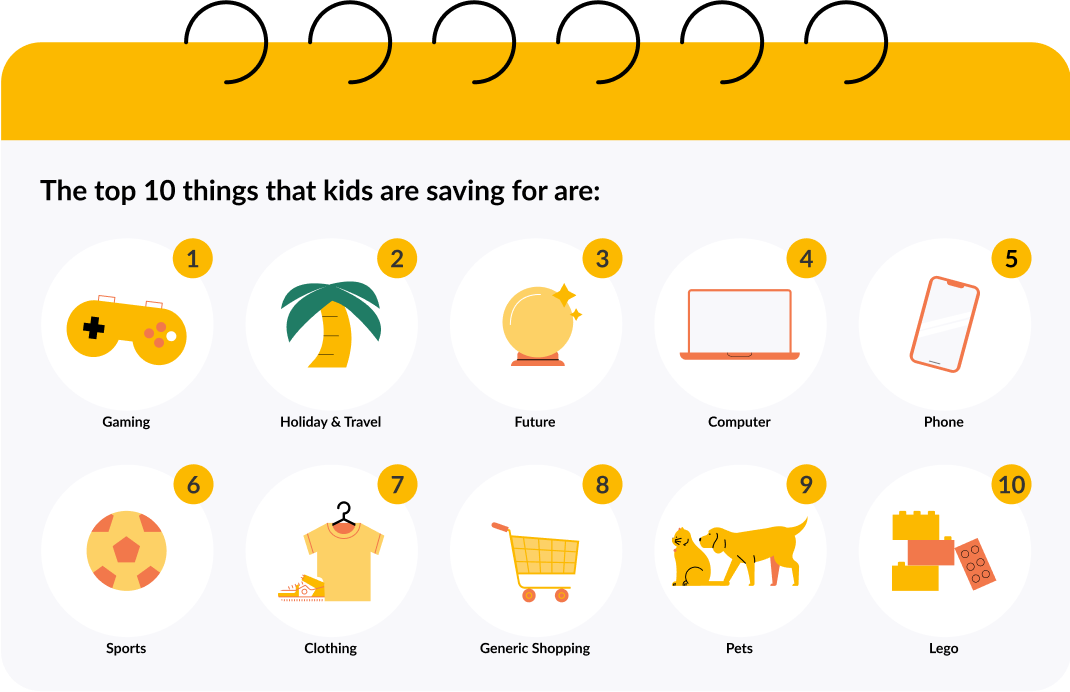

Kids are also continuing to demonstrate great budgeting skills by saving their money in a way that suits them. Similar to last year, 54% of savings were assigned to measurable goals for kids to work towards – such as saving up to buy a computer game, or for an upcoming holiday (using the Rooster Money app, Rooster kids are able to set up and move money into savings pots to help them save towards something special).

What are kids saving for?

Looking at savings pots, gaming continues to dominate the list as the goal with the most money transferred into it this year. Holidays came in at second place and saving for the future kept its top three spot for another year running, highlighting that kids aren’t just thinking about the here and now. Finally, pets were the newest entry to the list, suggesting that a number of Rooster Money kids are saving up for a furry friend (or maybe treats for them)!

Dive into the data

Spending

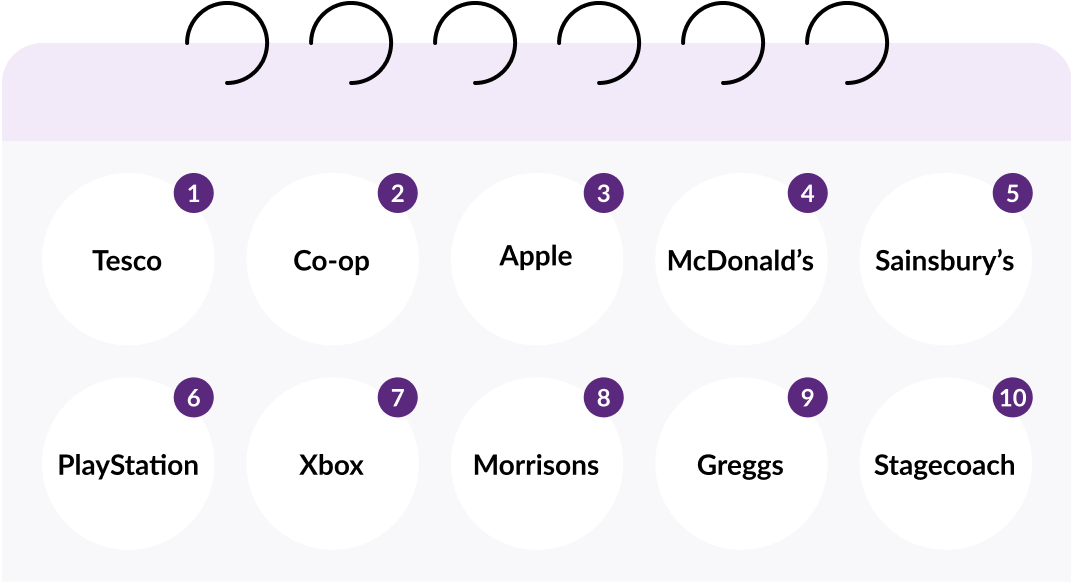

Supermarkets and grocery stores continue to see the most frequent spending amongst kids, with Tesco beating Co-op to first place as the brand with the most transactions this year, with Greggs and Morrisons also joining the list. Technology and gaming also remain top spending categories amongst today’s digital-savvy kids, with Apple, PlayStation and Xbox all making the list again.

This year, we saw Stagecoach make the top ten, suggesting that kids are using public transport to make the most of their independence – whether that’s travelling to school alone or visiting friends at weekends.

Where are kids spending their money?

When it comes to the places that kids were spending with most frequently, the following topped the list:

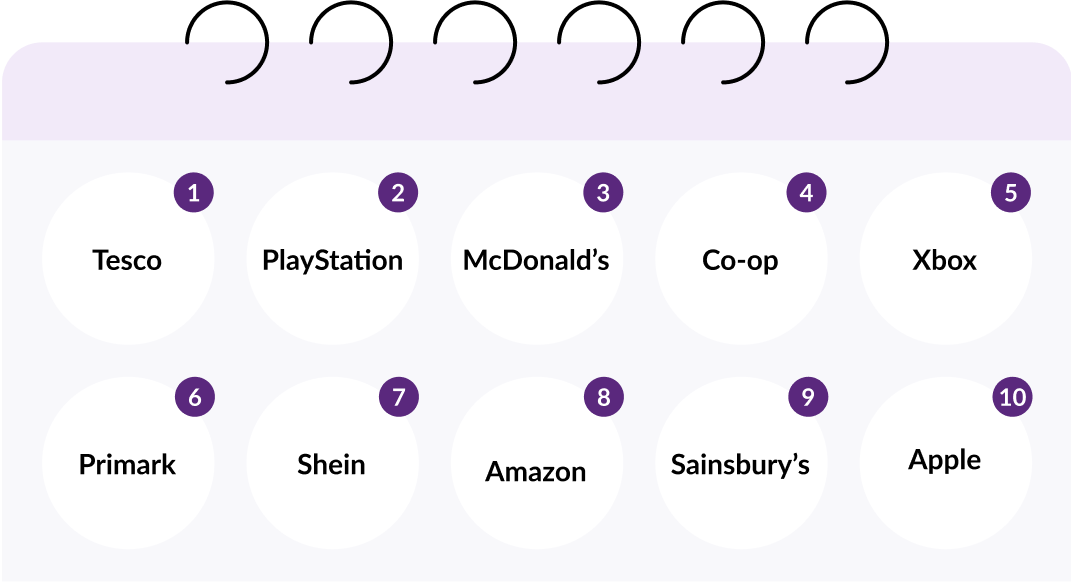

In terms of where kids spent the most money overall, Amazon was knocked off its top spot from last year and in fact fell down the rankings into 8th place. Meanwhile, Tesco moved up the rankings and replaced Amazon as the brand that kids spent the most on. This places Tesco at the top of both lists as the brand with both the highest number of transactions and the most money spent.

These are the places that kids spent the most at:

What does charitable giving look like?

Kids are still managing to give back to causes that matter to them through charitable donations. For another year running, the most donations went to cancer research and medical charities, followed by animal welfare and environmental causes.

Charities related to homelessness, poverty and social services received the most generous donations, averaging £4.80 per child.

We love to see the generosity of Rooster Money kids, demonstrating the importance they place on helping those less fortunate than them.

Learn more about pocket money

We've pulled together some handy resources to help you suss out everything pocket money