Their head start with money begins here

The independence they're asking for, with the reassurance you need.

NatWest, Royal Bank of Scotland, or Ulster Bank customer? Check out your exclusive Rooster Card offer here.

Help your kids learn to earn, save, and spend.

With the Rooster Card, your kids can start making considered spending choices both online and in stores.

Your kids can take the next step towards confident money management with your support, through flexible parental controls in the Rooster app.

Our secure card is built 100% with children in mind to help prepare them for a future of financial independence.

Spend and top-up limits apply. See details on fees and limits here.

From a NatWest, Royal Bank of Scotland, or Ulster Bank current account, you can directly top up Rooster Cards, or your Rooster Money Parent Account. You'll be able to see balances, too.

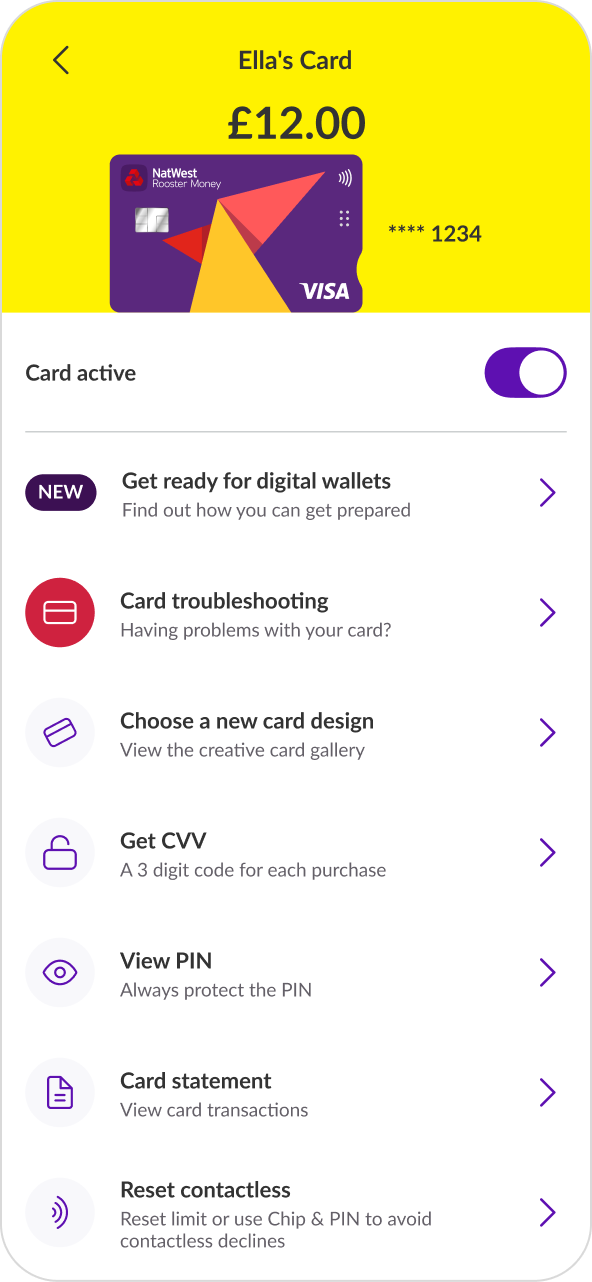

Hand over independence & maintain peace of mind

The Rooster Card lets them make considered spending choices with their own card – while you decide how much responsibility to hand over.

- Decide where it can be used: in stores, online or at ATMs

- Set flexible spending limits: Daily, Weekly or Monthly

- Instant top-ups (so they’re never caught short)

- Real-time notifications on when & where they spend

- All managed on-the-go-through the Rooster App (for parents & kids)

- Quick & hassle-free set-up

Get Apple Pay* or Google Pay™**

It makes paying a breeze for your child and you’ll keep the same level of parental controls.

- Pay with their phone – no problem if their Rooster Card is left at home

- An easier way to pay online or in app – no need to fill out long forms or create new accounts

- Secure contactless payments with every purchase

- Their card details are never shared with merchants

*Apple Pay is available on selected Apple devices. Child must be aged 13+ to use this service.

**Google Pay is available on Android 7 or higher. Child must be aged 13+ to use this service.

Google Pay is a trademark of Google LLC.

Pick their favourite

Making choices is a big part of growing up, and money.

When you order their Rooster Card, kids can pick from our trio of free designs. Or you could go for something a bit special – like these ones.

Find them all in your app.

Designs shown are £4.99. Card designs subject to availability.

As seen in

Build good money habits

With a contactless prepaid card linked to their Card pot, kids can:

- Log in to their own child account to manage their money

- Practise making considered spending choices

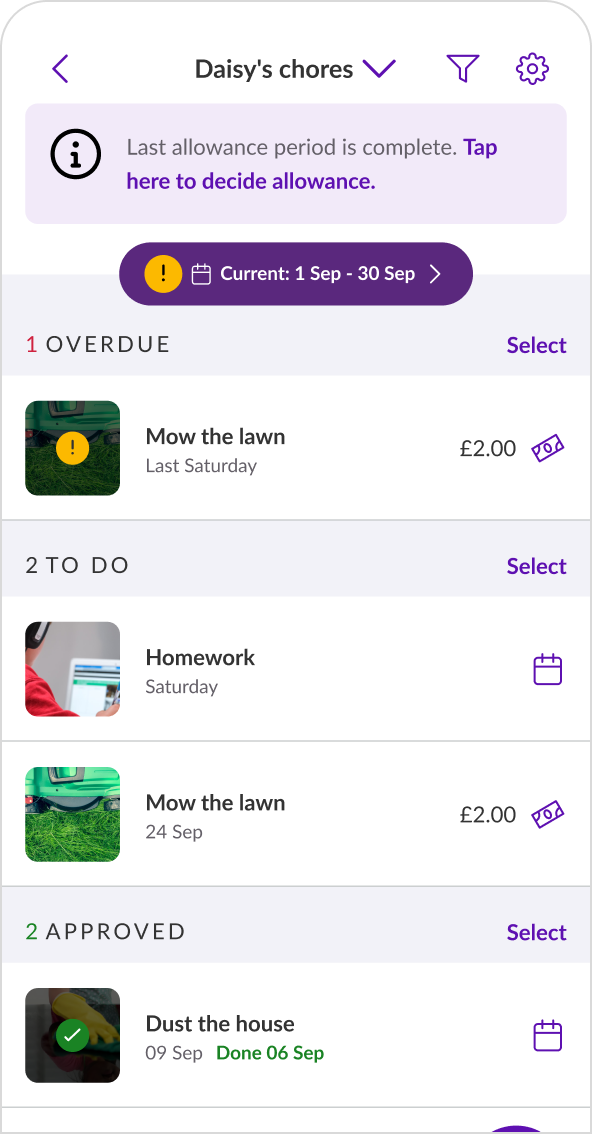

- Learn to earn with our chore-tracking feature

- Build their own Goal pots to save towards

- Receive instant spending notifications

- View spending habits via statements

- Buy things online and in store with no risk of going overdrawn

Safe & secure

We know safety is paramount when it comes to our kids which is why we’ve built in cutting-edge security features. This includes our one-time CVV system, which replaces the standard 3 digits on the back of the card, and significantly reduces opportunities for fraud.

- Freeze/Un-freeze card instantly if stolen (or just lost!)

- Decide where the prepaid debit card can be used: in shops, online or at ATMs

- Cards can’t be used in shops with over 18s merchant codes (like off licences & betting shops)

- One-time CVV – for more secure online purchases

- No overdraft, no debt, no risk of overspending

Anyone can contribute

Your Rooster Money Parent Account comes with its own sort code and account number. So gran and grandad can easily contribute to your children’s saving – useful at birthdays and Christmas! Limits apply.

- Your own family sort code and account number

- Easy payments in, by anyone

- Quick & hassle-free set-up

And still with all our existing Rooster Money app features

The Rooster Card is designed to be the perfect graduation from the Rooster Money app’s pocket money tracker, so when you upgrade, everything works seamlessly with all our existing features.

- Pocket money tracking

- Easy allowance management

- Advanced chore tracking system

- Auto-split allowance between Card, Save and Give pots

- Parent-paid interest

- Charity donations, powered by Just Giving

- And more – we are always adding new features!

And of course, lots of tips and advice on having positive conversations about money, starting with our Primers.

Read more in our accessibility statement.